The Nigerian Naira is more than just a medium of exchange; it is a symbol of national pride and economic strength. As the official currency of Nigeria, the Naira plays a crucial role in the nation's economy, influencing everything from inflation rates to international trade. With its vibrant designs and historical significance, the Naira stands as a testament to Nigeria's rich cultural heritage and economic aspirations.

Understanding the dynamics of the Nigerian Naira is essential for anyone interested in the economic landscape of Africa's most populous country. From its inception to its current status, the Naira has undergone significant transformations, reflecting the economic policies and challenges faced by Nigeria. Its value fluctuates due to various factors, including oil prices, government policies, and global economic conditions, making it a fascinating subject for economic study.

In this comprehensive analysis, we delve into the history, features, and impact of the Nigerian Naira on the global stage. We will explore its role in the everyday life of Nigerians, its influence on the country's economic strategies, and its future prospects amidst global economic shifts. Whether you're a student, economist, or simply curious about Nigeria's currency, this article offers valuable insights into the Nigerian Naira.

Read also:Steph Curry Age And Achievements Of A Basketball Icon

Table of Contents

- History of the Nigerian Naira

- Design and Symbolism

- Economic Significance

- How is the Value of the Naira Determined?

- Impact of Oil Prices on Naira

- Government Policies and the Naira

- Naira in International Trade

- Challenges Facing the Nigerian Naira

- Future of the Naira

- Digital Currency and the Naira

- How Does the Naira Affect Everyday Life?

- Investment Opportunities in Naira

- Naira Compared to Other African Currencies

- Frequently Asked Questions

- Conclusion

History of the Nigerian Naira

The Nigerian Naira was introduced on January 1, 1973, replacing the British pound as Nigeria sought to assert its independence and economic identity. Before the Naira, Nigeria used the Nigerian pound, a legacy of British colonial rule. The transition marked a significant shift in the nation's monetary policy, aiming to foster a stronger sense of nationalism and economic independence.

The introduction of the Naira came as part of a broader economic strategy to align with global currencies and facilitate easier transactions within Nigeria and with its international partners. Over the years, the Naira has undergone several changes in its design and denominations, reflecting efforts to curb inflation and combat counterfeiting.

The early years of the Naira were marked by relative stability, supported by Nigeria's booming oil industry. However, economic challenges in the 1980s and 1990s, including military rule and fluctuating oil prices, led to devaluations and increased inflation. These challenges shaped the evolution of the Naira, prompting various economic reforms and monetary policies aimed at stabilizing the currency.

Design and Symbolism

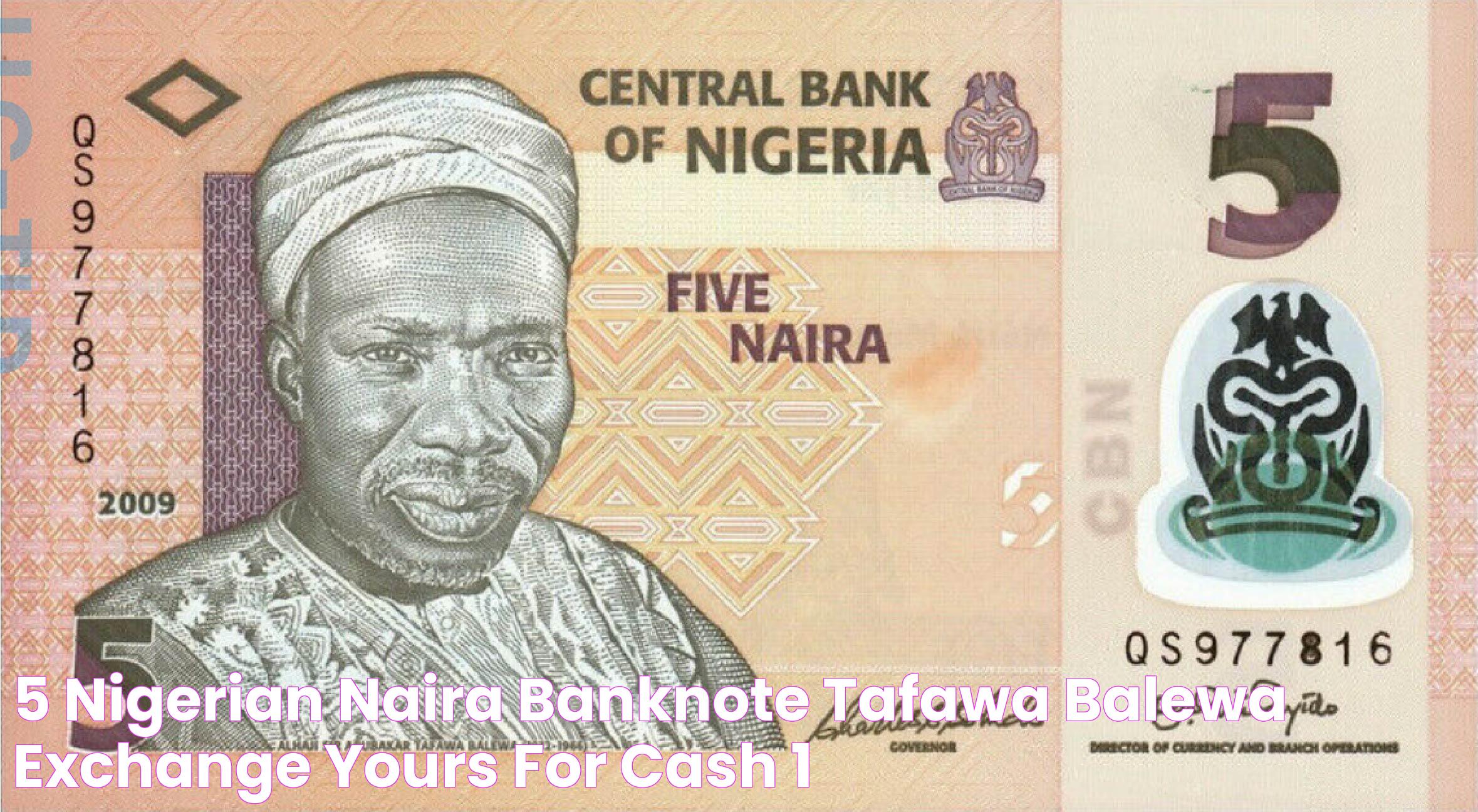

The design of the Nigerian Naira embodies the country's rich cultural heritage and national pride. Each denomination features images of notable Nigerian figures and symbols that reflect the diverse history and achievements of Nigeria. The vibrant colors and intricate patterns not only make the Naira visually appealing but also serve as a security feature to deter counterfeiting.

The front of the Naira notes typically features portraits of prominent Nigerian leaders and historical figures, while the back showcases scenes of cultural significance and economic activities, such as agriculture and education. This design approach aims to educate the public about Nigeria's history and achievements while fostering a sense of national unity.

In recent years, the Central Bank of Nigeria has introduced polymer notes to enhance durability and security. These notes are resistant to wear and tear, making them more cost-effective over time. Additionally, the use of advanced printing techniques and security features, such as holograms and watermarks, helps protect the integrity of the currency.

Read also:Whats The Strongest Metal Uncovering Natures Powerhouse

Economic Significance

The Nigerian Naira plays a pivotal role in the country's economy, serving as the primary medium of exchange for goods and services. It influences the purchasing power of Nigerians, affects inflation rates, and impacts the overall economic stability of the nation. As a result, the Naira's value is closely monitored by policymakers, businesses, and the public.

Fluctuations in the Naira's value can have wide-reaching effects on the economy. For example, a strong Naira can boost consumer confidence and increase imports, while a weak Naira can lead to higher inflation and reduced purchasing power. The Central Bank of Nigeria actively manages the Naira's exchange rate through monetary policies and interventions to achieve economic stability.

The Naira also plays a significant role in Nigeria's international trade. As one of Africa's largest economies, Nigeria engages in substantial trade with countries around the world. The Naira's exchange rate can affect the competitiveness of Nigerian exports and the cost of imports, influencing trade balances and foreign exchange reserves.

How is the Value of the Naira Determined?

The value of the Nigerian Naira is determined by several factors, including supply and demand dynamics in the foreign exchange market, government monetary policies, and global economic conditions. The Central Bank of Nigeria (CBN) plays a key role in managing the Naira's value through its monetary policy framework and interventions in the foreign exchange market.

The CBN uses various tools, such as adjusting interest rates and controlling money supply, to influence the Naira's value. Additionally, the CBN may intervene directly in the foreign exchange market by buying or selling foreign currency to stabilize the Naira's exchange rate. These interventions are often influenced by economic indicators, such as inflation rates, foreign exchange reserves, and balance of payments.

Global economic conditions, such as changes in oil prices and international trade dynamics, can also impact the Naira's value. As an oil-dependent economy, Nigeria's foreign exchange earnings are heavily influenced by oil exports. Fluctuations in oil prices can affect the supply of foreign currency, thereby impacting the Naira's exchange rate.

Impact of Oil Prices on Naira

The relationship between oil prices and the Nigerian Naira is a crucial aspect of the country's economic landscape. Nigeria is one of the largest oil producers in Africa, and oil exports account for a significant portion of the nation's foreign exchange earnings. Consequently, fluctuations in oil prices can have a direct impact on the Naira's value.

When oil prices rise, Nigeria's foreign exchange earnings increase, leading to a stronger Naira. This can boost consumer confidence and reduce inflationary pressures. Conversely, when oil prices fall, the reduced foreign exchange earnings can lead to a weaker Naira, increasing inflation and reducing purchasing power.

The dependence on oil revenues makes the Nigerian economy vulnerable to global oil price fluctuations. As a result, the government has implemented various strategies to diversify the economy and reduce reliance on oil exports. These efforts aim to create a more resilient economy that can withstand external shocks and stabilize the Naira's value.

Government Policies and the Naira

Government policies play a critical role in shaping the value and stability of the Nigerian Naira. The Nigerian government, in collaboration with the Central Bank of Nigeria, implements various monetary and fiscal policies to achieve macroeconomic stability and support the Naira.

Monetary policies, such as interest rate adjustments and money supply control, are used to influence inflation and stabilize the Naira's value. The CBN sets the monetary policy rate, which serves as the benchmark for lending rates in the economy. Changes in this rate can impact borrowing costs, consumer spending, and overall economic activity.

Fiscal policies, including government spending and taxation, also affect the Naira's value. Government budgets and expenditures influence economic growth, inflation, and foreign exchange reserves. Additionally, policies aimed at promoting economic diversification and attracting foreign investment can enhance the Naira's stability and resilience.

Naira in International Trade

The Nigerian Naira plays a significant role in the country's international trade activities. As a major player in the African and global markets, Nigeria engages in substantial trade with countries around the world. The Naira's exchange rate can impact the competitiveness of Nigerian exports and the cost of imports, influencing trade balances and foreign exchange reserves.

A stable and competitive Naira exchange rate can enhance Nigeria's export competitiveness, attracting foreign buyers and boosting economic growth. Conversely, an overvalued or undervalued Naira can affect trade balances, impacting foreign exchange reserves and economic stability.

The Nigerian government and the CBN implement various policies to support the Naira's stability in international trade. These policies include trade agreements, foreign exchange interventions, and export promotion strategies. By fostering a stable trade environment, Nigeria aims to enhance its economic competitiveness and resilience.

Challenges Facing the Nigerian Naira

The Nigerian Naira faces several challenges that impact its stability and value. Key challenges include inflation, exchange rate volatility, and external economic shocks. These challenges can affect consumer confidence, economic growth, and the Naira's purchasing power.

Inflation is a significant challenge for the Naira, as rising prices erode the currency's value and reduce purchasing power. The CBN implements various monetary policies to control inflation and stabilize the Naira's value. However, external factors, such as global commodity prices and supply chain disruptions, can impact inflationary pressures.

Exchange rate volatility is another challenge for the Naira, as fluctuations in the currency's value can impact trade balances and foreign exchange reserves. The CBN intervenes in the foreign exchange market to stabilize the Naira's exchange rate, but external factors, such as global economic conditions and oil price fluctuations, can affect the currency's stability.

External economic shocks, such as changes in global oil prices and international trade dynamics, can also impact the Naira's value. The Nigerian government has implemented various strategies to diversify the economy and reduce reliance on oil exports, aiming to create a more resilient economy that can withstand external shocks and stabilize the Naira's value.

Future of the Naira

The future of the Nigerian Naira is shaped by various economic and geopolitical factors. As Nigeria continues to navigate the challenges of a rapidly changing global economy, the Naira's stability and value will be influenced by government policies, economic diversification efforts, and global economic conditions.

Efforts to diversify the Nigerian economy and reduce reliance on oil exports are critical for the Naira's long-term stability. By promoting sectors such as agriculture, manufacturing, and technology, Nigeria aims to create a more resilient economy that can withstand external shocks and support the Naira's value.

Additionally, government policies aimed at enhancing fiscal discipline, improving infrastructure, and attracting foreign investment can support the Naira's stability and growth. By fostering a conducive economic environment, Nigeria can enhance its competitiveness and resilience in the global market.

Global economic conditions, such as changes in oil prices and international trade dynamics, will also impact the Naira's future. As a major player in the African and global markets, Nigeria's economic prospects and the Naira's value will be influenced by global economic trends and geopolitical developments.

Digital Currency and the Naira

The rise of digital currencies presents both opportunities and challenges for the Nigerian Naira. As digital currencies gain traction globally, they have the potential to impact traditional currencies, including the Naira, by influencing monetary policy, financial stability, and economic growth.

Digital currencies offer the potential to enhance financial inclusion and promote economic development in Nigeria. By providing access to financial services for individuals and businesses, digital currencies can support economic growth and stability. Additionally, digital currencies can facilitate cross-border transactions and reduce transaction costs, enhancing Nigeria's competitiveness in the global market.

However, the rise of digital currencies also presents challenges for the Naira, including regulatory and security concerns. The Nigerian government and the CBN are exploring the potential of digital currencies and considering regulatory frameworks to ensure their safe and effective use.

How Does the Naira Affect Everyday Life?

The Nigerian Naira plays a central role in the everyday life of Nigerians, influencing purchasing power, consumer behavior, and economic activity. As the primary medium of exchange, the Naira affects the cost of goods and services, impacting consumer spending and economic growth.

Fluctuations in the Naira's value can impact household budgets and consumer confidence. A strong Naira can boost consumer spending, supporting economic growth and job creation. Conversely, a weak Naira can lead to higher inflation, reducing purchasing power and impacting household budgets.

The Naira also affects access to essential goods and services, such as food, healthcare, and education. Changes in the Naira's value can impact the affordability of these goods and services, influencing the quality of life for Nigerians.

Investment Opportunities in Naira

The Nigerian Naira presents various investment opportunities for individuals and businesses. As Africa's largest economy, Nigeria offers a diverse range of investment opportunities across sectors such as agriculture, manufacturing, technology, and finance.

Investing in the Nigerian Naira can offer attractive returns, supported by the country's economic growth and development prospects. The Nigerian government and the CBN implement various policies to support investment and economic growth, fostering a conducive environment for investors.

However, investing in the Naira also presents risks, including exchange rate volatility and inflationary pressures. Investors should carefully consider these risks and seek professional advice when exploring investment opportunities in the Nigerian Naira.

Naira Compared to Other African Currencies

The Nigerian Naira is one of Africa's most significant currencies, reflecting the country's economic size and influence. Compared to other African currencies, the Naira's value is influenced by Nigeria's economic policies, global economic conditions, and external factors such as oil prices.

While the Naira faces challenges such as inflation and exchange rate volatility, it remains a key player in the African and global markets. The Nigerian government's efforts to diversify the economy and enhance fiscal discipline support the Naira's stability and competitiveness.

Comparing the Naira to other African currencies provides insights into Nigeria's economic prospects and the challenges and opportunities facing the continent's economies. As Africa's largest economy, Nigeria's economic policies and the Naira's value have significant implications for the region's economic development and stability.

Frequently Asked Questions

- What is the current exchange rate of the Nigerian Naira?

- How does inflation affect the Nigerian Naira?

- What role does the Central Bank of Nigeria play in managing the Naira?

- How does the Nigerian Naira compare to the US Dollar?

- What impact do oil prices have on the Nigerian Naira?

- Are there investment opportunities in the Nigerian Naira?

The exchange rate of the Nigerian Naira fluctuates based on market conditions, government policies, and global economic trends. It is essential to check reliable financial sources for the most up-to-date exchange rate information.

Inflation erodes the purchasing power of the Naira, leading to higher prices for goods and services. The Central Bank of Nigeria implements monetary policies to control inflation and stabilize the Naira's value.

The Central Bank of Nigeria (CBN) manages the Naira's value through monetary policies, foreign exchange interventions, and economic strategies. The CBN aims to achieve economic stability and support the Naira's value.

The Nigerian Naira's value compared to the US Dollar is influenced by economic factors such as inflation, exchange rates, and global economic conditions. It is important to monitor financial news and market trends for the latest information.

Oil prices significantly impact the Naira's value, as Nigeria relies heavily on oil exports for foreign exchange earnings. Fluctuations in oil prices can affect the Naira's exchange rate and economic stability.

Yes, there are various investment opportunities in the Nigerian Naira across sectors such as agriculture, manufacturing, technology, and finance. Investors should consider potential risks and seek professional advice when exploring these opportunities.

Conclusion

The Nigerian Naira is a central component of Nigeria's economic landscape, shaping everything from consumer behavior to international trade. Understanding the factors that influence the Naira's value is crucial for comprehending Nigeria's economic dynamics and future prospects. As the country continues to navigate the challenges of a rapidly changing global economy, the Naira's stability and value will be shaped by government policies, economic diversification efforts, and global economic conditions. With its rich history and cultural significance, the Naira remains a symbol of Nigeria's national pride and economic aspirations.

For further information on the Nigerian economy and currency, please visit the Central Bank of Nigeria.