Nigeria currency, known as the Naira, is not just a medium of exchange but a symbol of the nation's economic strength. From its introduction to its current state, the Naira has been a vital part of Nigeria's economic narrative. Understanding the intricacies of Nigeria currency can provide insights into the country's fiscal policies, trade dynamics, and overall financial health.

The Naira was introduced in 1973, replacing the Nigerian pound, which was the nation's currency at the time of independence in 1960. Over the decades, the Naira has undergone various transformations, influenced by both domestic and international economic factors. These changes have not only affected the purchasing power of the average Nigerian but have also played a crucial role in shaping the country's economic policies.

Today, the Nigeria currency faces several challenges, including inflation, fluctuating exchange rates, and the impact of global economic trends. Despite these hurdles, efforts are continuously being made to stabilize and strengthen the Naira. In this article, we will explore the history, challenges, and future prospects of Nigeria currency, providing a comprehensive understanding of its role in Nigeria's economy.

Read also:Unmasking Dry Humour A Witful Guide To Subtle Comedy

Table of Contents

- History of Nigeria Currency

- What is the Current Value of Nigeria Currency?

- Factors Affecting the Value of Nigeria Currency

- How is Nigeria Currency Manufactured?

- Role of Central Bank in Managing Nigeria Currency

- Impact of Inflation on Nigeria Currency

- Exchange Rates and Nigeria Currency

- How Does Global Economy Affect Nigeria Currency?

- Digital Currency and Nigeria

- Future Prospects of Nigeria Currency

- How Can Nigeria Currency Be Stabilized?

- Challenges Facing Nigeria Currency

- Investment Opportunities in Nigeria Currency

- Frequently Asked Questions

- Conclusion

History of Nigeria Currency

The history of Nigeria currency is a tale of transformation and adaptation. Before the Naira, Nigeria used the British West African Pound, which was in use until 1958. The Nigerian Pound was introduced in 1960 and remained in circulation until 1973 when the Naira was adopted. The introduction of the Naira marked a significant shift in Nigeria's monetary system, aligning it more closely with the global currency structure.

The Naira was initially pegged to the British Pound and later to the US Dollar. However, due to economic pressures and the need for monetary autonomy, Nigeria transitioned to a floating exchange rate system. This shift allowed the market to determine the value of the Naira, reflecting the supply and demand dynamics within the economy.

Over the years, the Naira has experienced various re-denominations and policy changes aimed at enhancing its stability. The most notable was in 1986 when Nigeria adopted the Structural Adjustment Program (SAP), which led to significant devaluation of the Naira. This was intended to make exports more competitive and reduce balance of payments deficits, but it also resulted in increased inflation and economic hardship for many Nigerians.

Today, the Naira continues to evolve, with ongoing efforts to balance its value against foreign currencies and maintain economic stability. The Central Bank of Nigeria (CBN) plays a crucial role in this process, implementing monetary policies and interventions to control inflation and stabilize the currency.

What is the Current Value of Nigeria Currency?

The current value of Nigeria currency is influenced by several factors, including market demand, economic policies, and global market trends. As of the latest data, the Naira's exchange rate against major currencies like the US Dollar, Euro, and British Pound fluctuates regularly, reflecting the dynamic nature of the global economy.

The official exchange rate as provided by the Central Bank of Nigeria often differs from the parallel market rate, which is influenced by speculative trading and market sentiment. This discrepancy can impact businesses and individuals who rely on foreign exchange for trade and investment purposes.

Read also:All About Ron Perlman His Height And More

To get an accurate picture of the Naira's value, it's essential to consider both the official and parallel market rates. This dual-rate system can create challenges for policymakers, as efforts to stabilize the official rate may not always reflect the realities of the market. Nonetheless, understanding these dynamics is crucial for making informed economic decisions.

In recent years, the Nigerian government has introduced various measures to stabilize the Naira, including foreign exchange controls and currency swap arrangements with other countries. These initiatives aim to boost liquidity and reduce reliance on the Dollar, thereby strengthening the Naira's value.

Factors Influencing the Current Value:

- Inflation rates

- Foreign exchange reserves

- Global oil prices

- Government fiscal policies

- Political stability

Factors Affecting the Value of Nigeria Currency

The value of Nigeria currency is affected by a myriad of factors, both internal and external. Understanding these factors is key to navigating the complexities of Nigeria's economic landscape. Here are some of the primary influences:

Internal Economic Policies:

Nigeria's monetary and fiscal policies have a direct impact on the value of the Naira. Policies aimed at controlling inflation, managing interest rates, and regulating foreign exchange are vital in maintaining currency stability.

Global Oil Prices:

As Africa's largest oil producer, Nigeria's economy is heavily dependent on oil exports. Fluctuations in global oil prices can significantly impact foreign exchange earnings and, subsequently, the value of the Naira.

Foreign Exchange Reserves:

The level of foreign exchange reserves held by the Central Bank of Nigeria affects the country's ability to stabilize its currency. Adequate reserves provide a buffer against external shocks and help maintain confidence in the Naira.

Political Stability:

Political stability is crucial for economic growth and currency stability. Political unrest or uncertainty can lead to capital flight, weakening the Naira and affecting investor confidence.

External Trade Relations:

Nigeria's trade balance and relations with other countries influence the demand for the Naira. A favorable trade balance can boost currency strength, while trade deficits may exert downward pressure on the Naira's value.

By understanding these factors, policymakers and stakeholders can develop strategies to enhance the stability and resilience of Nigeria currency in the face of economic challenges.

How is Nigeria Currency Manufactured?

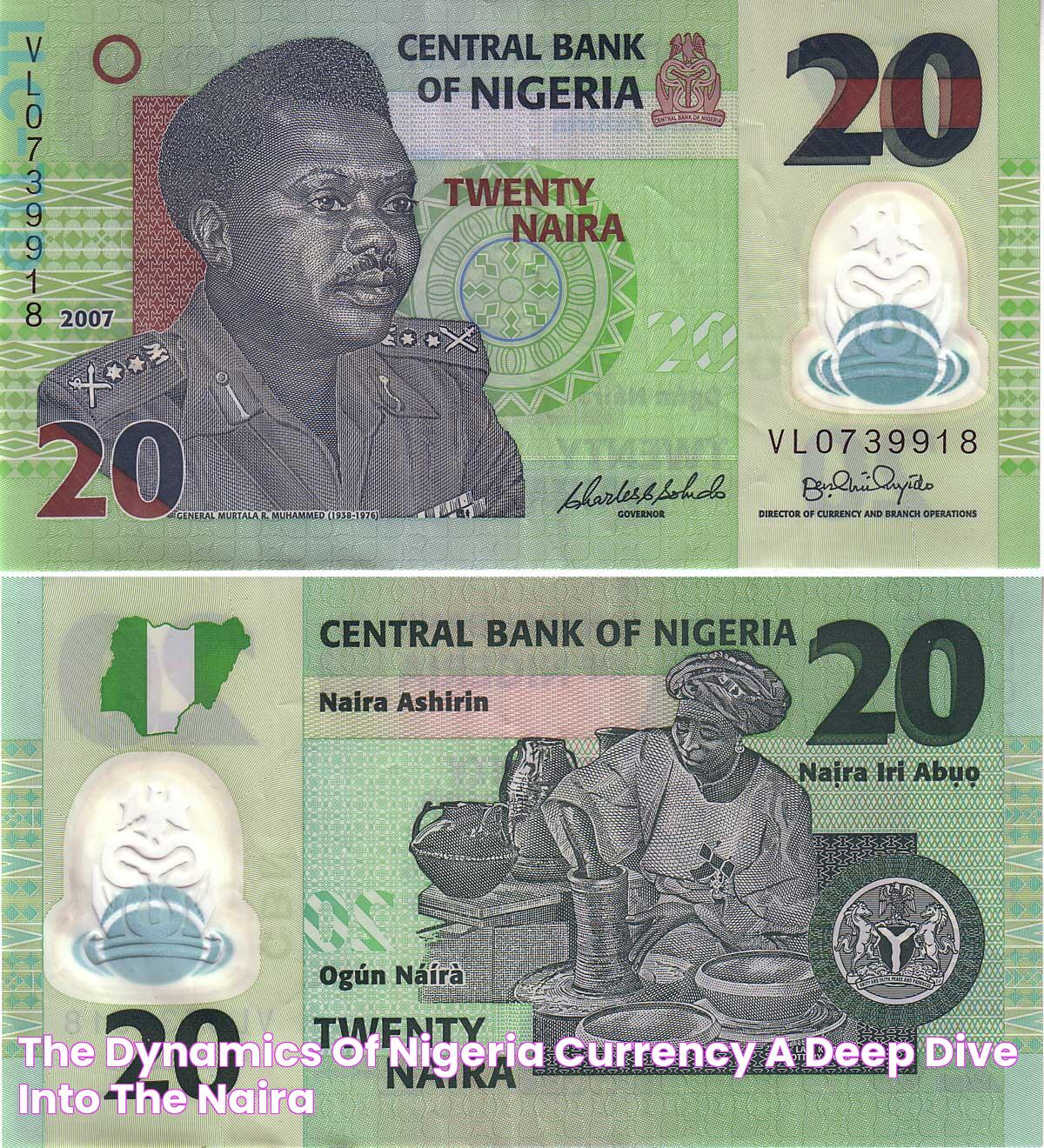

The manufacturing of Nigeria currency involves a complex process that ensures the production of secure and high-quality banknotes. This process is managed by the Nigerian Security Printing and Minting Company (NSPMC), which operates under the supervision of the Central Bank of Nigeria.

Design and Security Features:

The design of Naira banknotes incorporates advanced security features to prevent counterfeiting. These features include watermarks, security threads, holograms, and microprinting. The design process also involves selecting symbols and images that reflect Nigeria's cultural heritage and national identity.

Printing Process:

The printing of Naira banknotes is a sophisticated process that involves multiple stages, including intaglio printing, offset printing, and screen printing. Each stage adds layers of security and durability to the banknotes, ensuring their integrity and longevity in circulation.

Quality Control:

Quality control is a critical aspect of currency manufacturing. The NSPMC employs strict quality control measures to ensure that each banknote meets the required standards for security, durability, and aesthetic appeal. This involves rigorous testing and inspection at various stages of production.

Currency Distribution:

Once the banknotes are printed, they are distributed to commercial banks and financial institutions across the country. The Central Bank of Nigeria oversees this distribution process, ensuring that the currency supply matches the demand within the economy.

The manufacturing of Nigeria currency is a crucial component of the country's financial infrastructure, supporting economic transactions and facilitating trade and commerce.

Role of Central Bank in Managing Nigeria Currency

The Central Bank of Nigeria (CBN) plays a pivotal role in managing Nigeria currency, implementing policies and interventions to ensure its stability and integrity. The CBN's responsibilities include regulating the supply of money, controlling inflation, and maintaining a stable exchange rate.

Monetary Policy Implementation:

The CBN formulates and implements monetary policy to achieve macroeconomic stability. This involves setting interest rates, managing money supply, and regulating credit to control inflation and support economic growth.

Foreign Exchange Management:

The CBN is responsible for managing Nigeria's foreign exchange reserves and ensuring a stable exchange rate. This involves intervening in the foreign exchange market to address imbalances and prevent excessive volatility in the Naira's value.

Currency Issuance and Regulation:

The CBN oversees the issuance and regulation of Nigeria currency, ensuring that the supply of money aligns with the needs of the economy. This includes managing the production and distribution of banknotes and coins.

Banking Supervision:

The CBN supervises and regulates the banking sector to maintain financial stability and protect consumers. This involves setting standards for capital adequacy, risk management, and corporate governance within the banking industry.

Through these functions, the Central Bank of Nigeria plays a crucial role in maintaining the stability and confidence in Nigeria currency, supporting the country's economic development.

Impact of Inflation on Nigeria Currency

Inflation is a key factor that affects the purchasing power and value of Nigeria currency. High inflation erodes the value of money, reducing the real income of individuals and increasing the cost of goods and services.

Causes of Inflation in Nigeria:

- Supply chain disruptions

- Rising production costs

- Excessive money supply

- Exchange rate depreciation

- Government fiscal policies

In Nigeria, inflation is often driven by a combination of these factors, with exchange rate volatility and government spending playing significant roles. The depreciation of the Naira can lead to imported inflation, as the cost of imported goods rises, impacting the overall price level in the economy.

Effects of Inflation on the Naira:

Inflation can have several adverse effects on Nigeria currency, including:

- Reduced purchasing power

- Increased cost of living

- Higher interest rates

- Weakened consumer confidence

- Decreased investment attractiveness

To mitigate the impacts of inflation, the Central Bank of Nigeria implements monetary policies aimed at stabilizing prices and controlling money supply. These measures are crucial in maintaining the value of Nigeria currency and supporting economic growth.

Exchange Rates and Nigeria Currency

Exchange rates play a critical role in determining the value of Nigeria currency in the global market. They reflect the relative strength of the Naira against other currencies and influence trade, investment, and economic growth.

Types of Exchange Rates:

There are two main types of exchange rates that affect Nigeria currency:

- Official Exchange Rate: Set by the Central Bank of Nigeria, this rate governs transactions in the formal financial sector.

- Parallel Market Rate: Influenced by market forces, this rate is often higher than the official rate and is used in informal transactions.

Factors Influencing Exchange Rates:

The exchange rate of Nigeria currency is influenced by several factors, including:

- Interest rates

- Inflation rates

- Foreign exchange reserves

- Economic growth indicators

- Political stability

Fluctuations in exchange rates can have significant impacts on Nigeria's economy, affecting the cost of imports and exports, foreign investment, and the overall balance of payments. Understanding these dynamics is essential for businesses and policymakers in navigating the complexities of the global economy.

How Does Global Economy Affect Nigeria Currency?

The global economy has a profound impact on Nigeria currency, influencing its value and stability. As an integral part of the global financial system, Nigeria's economic performance is closely tied to international market trends and events.

Trade Relations:

Nigeria's trade relations with other countries affect the demand for the Naira. A strong trade surplus can boost currency value, while deficits may put downward pressure on the Naira.

Foreign Investment:

Foreign investment flows play a crucial role in supporting Nigeria's economic growth and currency stability. Increased investment can strengthen the Naira, while capital outflows can weaken it.

Global Economic Trends:

Global economic trends, such as changes in commodity prices, interest rates, and exchange rates, can impact Nigeria currency. As a major oil exporter, Nigeria is particularly sensitive to fluctuations in global oil prices.

By understanding the interplay between the global economy and Nigeria currency, policymakers and businesses can make informed decisions to enhance economic resilience and stability.

Digital Currency and Nigeria

Digital currency is emerging as a significant development in the financial landscape, with potential implications for Nigeria currency. The rise of cryptocurrencies and digital payment systems presents both opportunities and challenges for Nigeria's monetary system.

Opportunities:

- Increased financial inclusion

- Enhanced transaction efficiency

- Reduced transaction costs

- Greater access to global markets

Challenges:

- Regulatory issues

- Security concerns

- Volatility of digital currencies

- Potential for financial crimes

The Central Bank of Nigeria is exploring the potential of digital currencies and their integration into the national monetary system. This involves developing regulatory frameworks and policies to harness the benefits of digital currency while mitigating associated risks.

Future Prospects of Nigeria Currency

The future prospects of Nigeria currency are shaped by various economic, political, and technological factors. As Nigeria continues to navigate global economic challenges, the Naira's stability and growth potential remain key priorities for policymakers and stakeholders.

Economic Diversification:

Economic diversification is crucial for enhancing the resilience of Nigeria currency. Reducing dependence on oil exports and promoting other sectors, such as agriculture, manufacturing, and technology, can bolster economic growth and currency stability.

Monetary Policy Reforms:

Implementing effective monetary policy reforms can help stabilize Nigeria currency and control inflation. This involves enhancing the Central Bank's capacity to manage money supply, interest rates, and exchange rates.

Strengthening Financial Infrastructure:

Investing in robust financial infrastructure, including digital payment systems and regulatory frameworks, can support the stability and growth of Nigeria currency. This involves leveraging technology to enhance financial inclusion and efficiency.

By pursuing these strategies, Nigeria can enhance the prospects of its currency and support sustainable economic development in the long term.

How Can Nigeria Currency Be Stabilized?

Stabilizing Nigeria currency is a complex task that requires coordinated efforts from the government, Central Bank, and private sector. Here are some strategies to achieve currency stability:

Enhancing Foreign Exchange Reserves:

Building and maintaining adequate foreign exchange reserves can provide a buffer against external shocks and support the stability of the Naira.

Controlling Inflation:

Implementing effective monetary and fiscal policies to control inflation can help maintain the purchasing power of Nigeria currency and boost investor confidence.

Promoting Economic Diversification:

Diversifying the economy away from oil dependence can enhance resilience to global market fluctuations and support currency stability.

Strengthening Governance and Institutions:

Improving governance and institutional capacity can enhance policy implementation and foster a stable economic environment conducive to currency stability.

By adopting these measures, Nigeria can enhance the stability of its currency and support sustainable economic growth.

Challenges Facing Nigeria Currency

Nigeria currency faces several challenges that impact its stability and value. Addressing these challenges is crucial for maintaining economic growth and development.

Inflationary Pressures:

High inflation erodes the value of Nigeria currency and reduces purchasing power. Controlling inflation is a key priority for policymakers.

Exchange Rate Volatility:

The dual exchange rate system creates challenges for currency stability, as discrepancies between official and parallel market rates can lead to market distortions.

Dependence on Oil Exports:

Nigeria's reliance on oil exports makes the economy vulnerable to global oil price fluctuations, impacting foreign exchange earnings and currency stability.

Political and Economic Uncertainty:

Political instability and economic uncertainty can lead to capital flight and weaken Nigeria currency, affecting investor confidence and economic growth.

Addressing these challenges requires coordinated efforts from the government, Central Bank, and private sector to enhance the resilience and stability of Nigeria currency.

Investment Opportunities in Nigeria Currency

Despite the challenges facing Nigeria currency, there are investment opportunities for those willing to navigate the complexities of the market. Here are some potential areas for investment:

Government Securities:

Investing in Nigerian government securities, such as Treasury bills and bonds, can offer attractive returns and provide a hedge against currency volatility.

Foreign Exchange Market:

Participating in the foreign exchange market offers opportunities for profit through currency trading, although it requires a thorough understanding of market dynamics and risks.

Real Estate and Infrastructure:

Investing in real estate and infrastructure projects can provide long-term returns and contribute to economic development and currency stability.

Emerging Sectors:

Exploring opportunities in emerging sectors, such as technology, agriculture, and renewable energy, can offer growth potential and support economic diversification.

By leveraging these opportunities, investors can capitalize on the potential of Nigeria currency and contribute to the country's economic development.

Frequently Asked Questions

What is the official currency of Nigeria?

The official currency of Nigeria is the Naira, introduced in 1973 to replace the Nigerian Pound.

How does inflation affect Nigeria currency?

Inflation erodes the purchasing power of Nigeria currency, increasing the cost of goods and services and reducing real income.

What is the role of the Central Bank of Nigeria in currency management?

The Central Bank of Nigeria manages the supply of money, controls inflation, and stabilizes exchange rates to ensure currency stability.

How can Nigeria currency be stabilized?

Enhancing foreign exchange reserves, controlling inflation, promoting economic diversification, and strengthening governance can stabilize Nigeria currency.

What are the challenges facing Nigeria currency?

Challenges include inflationary pressures, exchange rate volatility, dependence on oil exports, and political and economic uncertainty.

Are there investment opportunities in Nigeria currency?

Yes, investment opportunities include government securities, foreign exchange market, real estate, infrastructure, and emerging sectors.

Conclusion

Nigeria currency, the Naira, is a vital component of the country's economic framework. Understanding its history, challenges, and future prospects provides valuable insights into Nigeria's economic landscape. Despite the challenges, there are opportunities for growth and stability through strategic economic diversification, effective monetary policies, and investment in emerging sectors. By addressing these challenges and leveraging opportunities, Nigeria can enhance the value and resilience of its currency, supporting sustainable economic development and prosperity.